Should You Open Up A Merchant Account With Your Bank?

The acquiring financial institution would certainly need to independently validate each purchase before approval, a process that can take days. A variety of attributes to assist you expand and also scale your business. You might be questioning why you can't just link your service checking account with your repayment processor to get your credit card sales down payments. There would be lengthy delays as your financial institution and also consumers' card-issuing banks validate each purchase prior to accrediting the sale. Every merchant account carrier will bill transaction fees, to cover the price of repayment handling. Some accounts might or may not bill a month-to-month fee, along with the purchase charge.

How long does it take for a merchant to name on card meaning receive funds?

Usually the wait time is between 3-5 business days.

We're a registered representative and also organization development solution. However, we deal with payment cpus to discuss rates and also service arrangements for our clients. As an example, brick-and-mortar store that only approves repayments in person provides a reduced threat of fraudulence than a company that takes card info over the phone or online. Your service's sales quantity, average purchases, typical ticket dimension, and even how your clients pay, all affect your eventual rates and also the regards to your seller agreement. This can be tough for brand-new sellers without an established sales history, so you'll need to work up reasonable price quotes based upon your current expectations.

Settlement Depot

Other than that, you'll probably requirement to confirm your service even more by submitting financial statements, previous processing history, and business policies. It is very important to get the right rates framework for your service. But bigger, high-volume businesses can conserve with a subscription-based service provider. This may function best for consultants, neighborhood experts, or B2B organizations.

Nonetheless, a specialist check from a company account will certainly share professionalism and also, extra importantly, confidence. As an example, utilizing a different business account makes it much easier come tax obligation time, as you will certainly need to file your business revenue and expenses separately from your individual transactions. Separating individual expenses from overhead when they are in the same account can be time consuming and also troublesome. CreditDonkey is a charge card handling contrast web site. We publish data-driven evaluation to aid you save money & make wise choices. If you have inadequate credit history, a history of missed repayments, or an extreme amount of chargebacks, that could make opening a seller account harder.

Internet Merchant Accounts

You may additionally take into consideration asking several of the concerns provided right here when picking a supplier. Repayment cpu is most likely an additional term you'll have come across however might not understand what it implies. It may assist to consider this as putting your card right into a card equipment in a store. Numerous or all of the products featured here are from our partners who compensate us. This might influence which products we cover and where and exactly how the item shows up on a web page. Below is a list of our companions as well as here's exactly how we make money.

- Sure, banks might waive details charges if you additionally process charge card with them, however not all banks bill them anyway, so in all likelihood, you're not truly saving anything.

- Sell in-store and also on-line perfectly, with built-in tools for stock management, sales and also staffing.

- Throughout his occupation, Walker has actually composed extensively in support of his small business customers, examining their financial problem and making recommendations on their borrowing choices.

To assist, we have actually published a comprehensive overview to merchant account and also credit card processing charges so you can determine just how they may influence your organization. The expense of having your own private vendor account could exceed the benefit. With a PSP, your organization account is aggregated with those of other merchants.

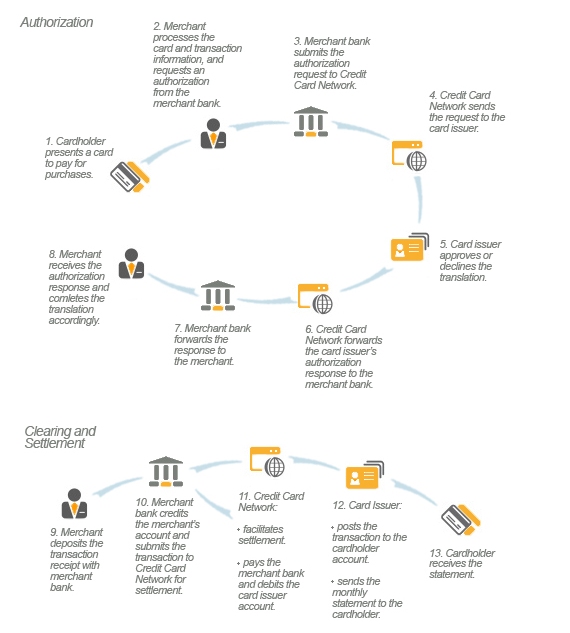

Paymentsense Limited is authorised and controlled by the Financial Conduct Authority and also under the Electronic Money Rules for the issuing of cybercash and stipulation of payment services. What is a vendor account, and exactly how do merchant accounts work? To figure out more concerning seller solutions as well as card processing, visit our thorough overview. Accept extra customers by accepting cards with Dojo sophisticated card devices. There are means to minimize fraudulence with CNP, by asking the cardholder to validate their address registered with their debit or bank card. Note, however, that you might not disclose all of this details immediately.

What is a merchant wallet?

Merchant Wallet means Merchant's account maintained with the bank or financial institution licensed under the Banking and Financial Institutions Act 1989 in Malaysia; means Merchant's account in the MM System in which Merchant's electronic money and Commission are stored; Sample 1.

Additionally, merchant accounts for bad credit it makes tax filing simpler given that you'll have various statements for your individual revenue as well as expenses and those of your organization. Company checking account may likewise use different rewards and also incentives to benefit your company. Uses an interchange-plus pricing design for their vendor solutions, that include an online terminal, consumer database and also online reporting.

Kontempo lands fresh capital amid the boom for B2B BNPL - TechCrunch

Kontempo lands fresh capital amid the boom for B2B BNPL.

Posted: Thu, 04 Aug 2022 13:48:02 GMT [source]

Plus, you can get reduced processing rates than a flat-rate PSP can offer. Try to find an interchange-plus or subscription-based seller account - the markups are much lower. That can translate into numerous bucks in savings monthly. New or small businesses don't need a full-fledged merchant account. Below are some options to obtain repayments without a seller account.

Can I transfer money from merchant account to bank?

First, you'll need to transfer the funds from your merchant account to your business bank account — and this might take up to two weeks. After the Click here money lands on your business account, you'll be able to reach it through your bank's app on your smartphone and do whatever you wish with it.